*Some of the links in this post are affiliate links. This means that at no additional cost to you, I will earn a commission for items that you purchase. For more information, please refer to my disclosure policy.

Key Takeaways

- The purpose of opening an emergency fund is to plan ahead for your future.

- Money kept in an emergency fund helps you pay for unexpected costs without going into debt or losing your home.

- The best place to store an emergency fund is somewhere that is easily accessible in a short amount of time.

Emergency Fund Meaning

Financial terms are thrown around all the time, but truly understanding the purpose behind starting an emergency fund is what sets you apart from others who simply earn and spend as they go. The whole meaning of an emergency fund is to plan ahead, not to spend your money freely without giving it a second thought.

If you want to build wealth, the very first thing you need to do is to realize that it’s going to take some time and effort on your part. No one is going to hand anything to you in this life, so you need to take this very important responsibility into your own hands. And I promise you that you’ll never regret it once you do.

Only in extreme circumstances do people become rich overnight. While the majority of us have to put in the work necessary to take our financial status to the next level. But that’s okay because hard work leads to success, and success leads to an incredible amount of pride and satisfaction in your life.

There are plenty of ways to grow wealth that actually work. And you don’t have to be born rich or qualify as a genius to make it happen for you.

In fact, anyone on any income level can accumulate wealth and build a secure financial future for their family. As long as you have the mental capacity to understand simple math concepts and the physical capacity to work for a living, you’re smart enough and capable enough to do what it takes to get there.

Just a few years ago, I was struggling hard. I suddenly became a single mom to two young children, and I had to reenter the workforce after many years of staying at home to raise them. I accepted the first job I could get with a very low entry-level salary, but I was determined to build a better life for my kids and for myself. So that’s exactly what I did.

Just a few short years later, I’ve accomplished incredible things personally, professionally, and financially, and there was no luck or magic about it.

You may be surprised to learn that the foundation of growing wealth is actually saving money and investing it—not using any secret tricks to get you there. You don’t have to win the lottery, pick the next hot stock, or get involved in a multi-level marketing (MLM) venture. In fact, I suggest you don’t try to hit it rich by doing any of those things because they’re all next to impossible.

Instead, I educated myself about personal finance, saving, and investing. And now we will never have to go without again.

My personal goal is to show you just how easy it can be to pull yourself out of financial disaster and into financial security once you put your mind to it. In fact, something as simple as understanding the meaning of an emergency fund and how to invest in one can actually be your one-way ticket to wealth.

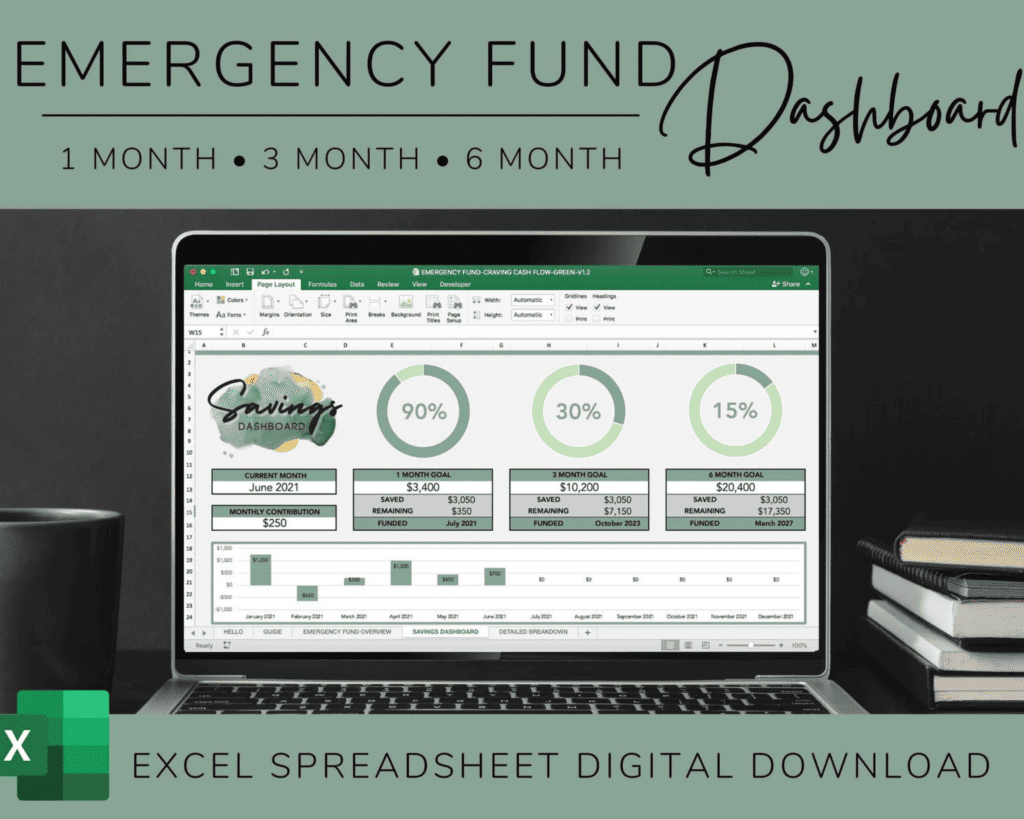

Brooke’s Top Pick for an Emergency Fund Dashboard

Emergency Fund Spreadsheet by CravingCashFlow

• 1, 3, and 6-month emergency funds

• Auto calculate savings summary

• Progress graphs and charts

• Digital download

What is an Emergency Fund

To understand how an emergency fund can be the very foundation for growing wealth, it’s important to understand what an emergency fund actually is—and what it’s not.

An emergency fund is a stockpile of money that you save in order to cover any surprise expenses that may come your way. The entire purpose of an emergency fund is to ensure that you don’t run out of money or take on debt as a result of an emergency situation.

Having a hefty savings account is the first thing that sets people apart. You’re either financially stable or you’re one emergency away from being homeless. And that’s not an exaggeration.

According to a recent survey by Bankrate, 51% of Americans have less than a 3-month cushion in savings. That means that when your car breaks down, your furnace dies, you get laid off from your job, or the next pandemic shutters business doors, you could very well end up with no money at all and nowhere else to go.

That’s why it’s so important to understand how to build an emergency fund and what an emergency fund can actually be used for.

How to Build an Emergency Fund

There are plenty of right ways to build an emergency fund but only one wrong way to build an emergency fund—and that’s to never get started.

The secret to building an emergency fund is to set achievable goals, make a financial plan, and get started as soon as you can.

When you feel like you’re already drowning in financial ruin, it can feel impossible to pull yourself out of it. And those feelings of being overwhelmed turn into hopelessness, leading people to just give up. But here’s the thing, when you give up, you’re guaranteeing that your financial picture will never change and that you’ll stay paycheck to paycheck forever.

Instead, embrace your inner stubbornness and refuse to give up no matter how hard it may seem. The next thing you know, you’ll have $100, then $1000, then $10,000 to your name, and you’ll be so thankful that you finally got started.

Here are 10 steps to help you build an emergency fund today:

- Calculate your monthly expenses.

- Set a small savings goal.

- Track your spending habits.

- Cut out any unnecessary spending this month.

- Set up automatic payments to your savings account.

- When you do purchase something, take your change and put it into savings.

- Contribute any work bonuses or tax returns to savings.

- Monitor your savings progress throughout the month.

- Once you reach one savings goal, set another small savings goal to start working toward.

- Celebrate all of your financial successes no matter how small they are.

Building an emergency fund will take time and effort on your part. But the money you save in an emergency fund can be used for things you probably never even expected.

Brooke’s Top Pick for a Savings Challenge Bundle

Ultimate Savings Challenge Bundle by HoneydewHive

• 100 challenges + 2 bonus challenge

• You choose the savings amounts

• DIY envelopes

• Digital download

What is an Emergency Fund Used For

Now that you know what an emergency fund is and how to build an emergency fund no matter what income level you’re at, it’s important to understand what an emergency fund can actually be used for.

Emergency funds can certainly be used during emergency situations that cause you to have unexpected bills. But having an emergency fund can also help keep you out of debt, grow your savings more quickly, and help you spend less on everyday purchases too.

Having that extra cushion of cash empowers you in more ways than you could probably ever imagine.

Unexpected medical bills arise, utility bills skyrocket, car accidents happen, and divorces take place. Having a savings account can help you through all of these tough situations, but it can also set you on a path to building wealth.

Here are 13 examples of how an emergency fund can be used to help you grow rich:

- You won’t have to rely on payday loans and get stuck with exorbitant fees.

- You will avoid paying the minimum balance, check cashing, or overdraft fees at banks.

- You won’t have to pay high-interest rates on credit cards and loans when you purchase items with cash.

- You can often avoid paying unnecessarily large deposits to utility companies and landlords.

- You can buy items in bulk and stock up when items are on sale.

- You won’t need to pawn your personal belongings.

- You won’t be hit with late fees after unexpected expenses.

- You can take time off from work to interview for higher-paying jobs and to take care of sick family members, without the worry of losing a day’s pay.

- You will pay less for auto insurance and lower interest rates as your credit score goes up.

- You will avoid the high cost of rent-to-own furniture or buying on store credit cards.

- You won’t need to put items on layaway.

- You can pre-pay bills for a cash discount.

- You will start making interest on the money you keep in your savings account. That’s free money!

The act of building a savings account will emergency-proof your finances. But it can also catapult you into a higher savings rate overall so that you can stop wasting money on unnecessary fees, deposits, and interest payments.

Why You Need an Emergency Fund

There are so many reasons why it’s a great idea to save more and spend less no matter what income level you’re at. While so many others around you are living at or above their means, you’ll realize quickly just how much more satisfying life is when you live frugally, get ahead financially, and eventually reach financial independence.

The number one reason you need an emergency fund is that it protects you against any surprise expenses that come up during your lifetime. Having a well-funded emergency fund keeps you out of debt, and it keeps your other assets safe as well.

Plus, an emergency fund gives you financial freedom, so that you never have to rely on predatory lenders with exorbitant fees, family members, or friends to bail you out after a crisis again.

In fact, once you open, and fully fund, an emergency account, you take control of both your finances and your life.

Emergency Fund Amount

When it comes to determining the right emergency fund amount that you need, it’s best to think in terms of tiers. Start out by making small goals that you can easily reach and then move on from there until you have a fully stocked emergency fund that guarantees your financial freedom.

Just saving enough for a one-month emergency fund will help you cover many of the smaller emergencies that might come up at any given time, and it will help you build strong financial goals for a lifetime.

Once you have this one-month cushion, your financial stress will start to evaporate, and then you can look at ways to save even more. Your next goal should be to get enough saved for three months’ worth of expenses.

At this point, you can really focus on continuing to cut all of your expenses, save more, and pay less for items by buying in bulk, on sale, or with cash discounts. Just three months’ worth of savings can give you a new sense of freedom and an increased buying power that you never had before.

The next step is to save six months of expenses, which will help you build financial security in the event of an unexpected job loss. If you get downsized with six months’ worth of expenses saved up, you’ll have plenty of time to find another job.

At that point, you’ll no longer be in crisis mode, and you can take the time you need to find the right job—not just any job.

Lastly, once you’re really starting to enjoy your new financial security, you can set your sights on building an FU fund. An FU fund is the ultimate emergency tool because it allows you to walk any from any toxic job, situation, or relationship without any fear of financial repercussions.

Remember, money can equal freedom when you use it wisely.

It may not be fun to say no to an expensive night out, you may feel disappointed when you can’t always buy something you really want right now, and it’s not always easy to say no when your kids are begging you for something at the store.

But trust me, the more you save up, the more security and happiness you’ll feel.

Where to Put an Emergency Fund

The unfortunate thing about emergencies is that they always seem to happen when you’re short on cash or you have a really busy schedule ahead. So part of the emergency fund planning process is being intentional with where that money is kept to minimize the stress it causes you.

The best place to put an emergency fund is anywhere that is easily accessible in a short amount of time. Storing your emergency fund in any type of account that you have to wait in order to access is never a good idea.

Thinking back to the tiered approach, you may want to consider keeping one to three months’ worth of expenses in a traditional savings account at an in-person bank or credit union near you. That way, you can gain access to it quickly when something unfortunate happens.

Because the interest rate is so low on most savings accounts, you then want to store any additional funds in other types of accounts that earn more money but can still be accessed quite quickly without too much of a hassle. Examples of these types of accounts are high-yield savings accounts at an online bank, money market accounts, CDs, and Roth IRAs.

What matters is that you have that cushion of cash just when you need it most and you can get your hands on it.

FAQs

1. How much should I keep in an emergency fund?

The amount of money you should keep in an emergency fund largely depends on your personal financial picture. At a minimum, shoot to save one month’s expenses when you begin, then increase the savings in your emergency fund to cover your expenses for three months, six months, and then one year as soon as possible.

2. Where should I invest my emergency fund?

Your emergency fund should always be kept in a place where you can access it quickly and easily without penalties or fees. Savings accounts and even no-fee checking accounts are great options for emergency funds. Just make sure it is located in a separate account and not commingled with your other money.

3. Should I keep my emergency fund in a Roth IRA?

Roth IRAs are a great vehicle for investing long-term. Keep in mind, though, that you must meet the minimum requirements for withdrawal, or you could face taxes and penalties. Plus, they’re riskier than a traditional savings account, so they’re not a great option for storing the entirety of an emergency fund for many people.

Sources

- Bankrate: Survey: More Than Half of Americans Couldn’t Cover Three Months of Expenses With an Emergency Fund

- Federal Trade Commission: The Case (for and) Against Multi-Level Marketing

Love What You’re Seeing So Far?

- Enjoy community support

- Never miss a life-changing post again

- Get immediate access to the free resources library

- Be the first to know about giveaways

What can you do to start building more savings today? Share your thoughts in the comments section below.