*Some of the links in this post are affiliate links. This means that at no additional cost to you, I will earn a commission for items that you purchase. For more information, please refer to my disclosure policy.

Can’t Get Ahead Financially

If you can’t get ahead financially, you’re certainly not alone. Having a full-time job is no guarantee that you’ll be able to pay your bills, save money, and invest in your future these days. People are finding it harder than ever before to get ahead financially, especially on one source of income.

Shockingly, 77% of people in the United States are worried about making ends meet. That’s a huge number of people who don’t have financial security. And if you feel like the entire system is out to get you, I have bad news—it kind of is.

In all actuality, the poorer you are, the more you pay for virtually everything. And it becomes nearly impossible to break free of the vicious cycle of fees that compound against you—a huge problem when you’re already struggling and can’t get ahead financially.

But just because you can’t get ahead financially now doesn’t mean you’re stuck in financial turmoil forever. It is possible to get ahead financially no matter what your income level is and learning how to get ahead financially is as simple as making the decision to do so and taking the necessary steps to make that happen consistently.

What to Do When You Can’t Get Ahead Financially

Wondering what to do when you can’t get ahead financially? The key is to educate yourself on how to make your money work for you instead of against you.

Less than ten years ago, I was broke as a joke. I hadn’t worked outside the home in many years, had no money in my own name, and hopelessly watched my combined savings account get split four ways between myself, my soon-to-be ex-husband, and our two divorce lawyers. I wasn’t in a good financial situation at all, and I needed to get a job fast. Any job would do at that point.

The worst part of starting over completely was learning that all of the frugal living and saving strategies that I had always used before wouldn’t work on such a low income. I no longer had the same buying power I once had, so I had to pay a lot more to buy a lot less.

I’ll never forget crying on the phone with my sister while I was at the grocery store one day. I needed batteries, and they were way more expensive than I was used to paying since I could only afford to buy the smallest package at the time. Since going through my divorce, I had gone from buying everything in bulk to scraping together whatever I could just to get by.

I would love to tell you that that was the only time I cried over money, but I would be lying through my teeth. The next year or so was a huge struggle for me, and I had a lot of lessons to learn along the way.

It became more and more obvious to me that the system is definitely against you the poorer you are. If you’re low-income, it will be much harder for you to get ahead. But I promise you, it’s not impossible. Even though it definitely may seem that way at times.

The most important thing to remember is that anyone, and I mean anyone, can make the system work for them—not against them.

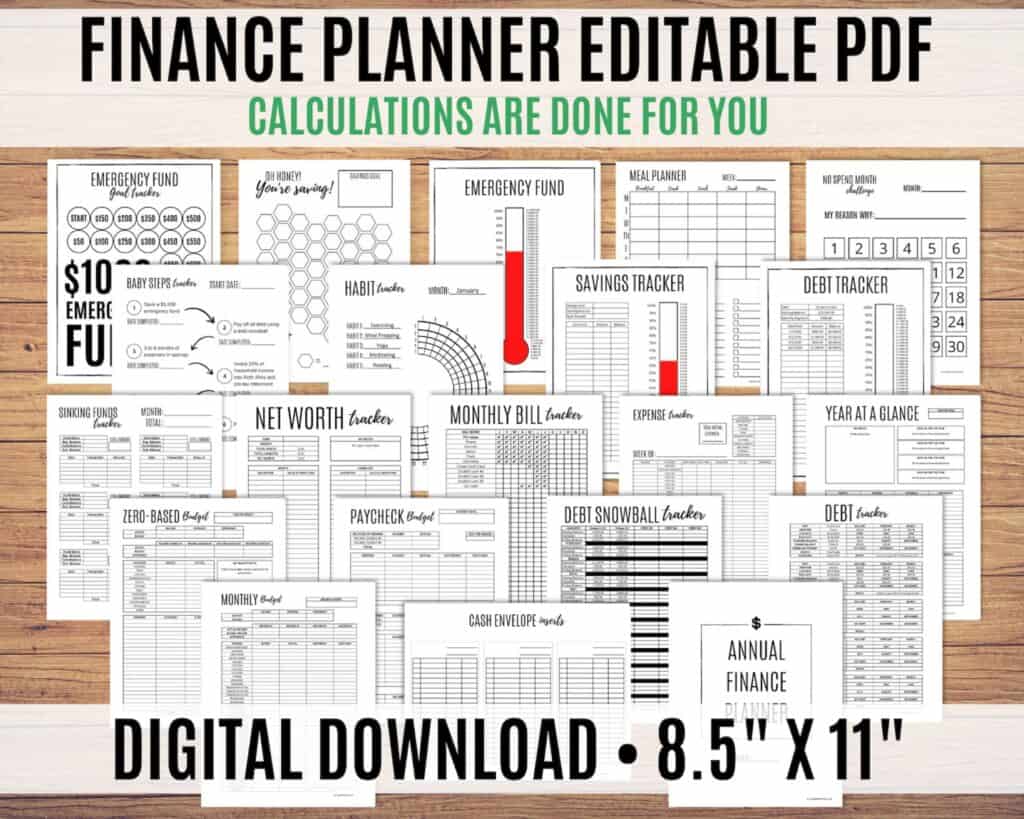

Brooke’s Top Pick For A Financial Planner

Financial Planner Editable PDF by YourFrugalFriend

- 21 personal finance resources

- Editable PDF with calculations done for you

- Great for budgeting, debt payoff, savings tracker, and calculating your net worth

- Comes with a meal planner and cash envelope inserts

Why You Can’t Get Ahead Financially

The most likely reason why you can’t get ahead financially is that you spend too much of your income and you save too little of it. When bills, debt repayments, and impulse purchases add up to your monthly income or more, it prevents you from ever getting ahead.

Remember, you can’t fix a problem when you don’t know its cause. Many people have a hard time figuring out exactly why they continue to struggle with money day by day. To end this vicious cycle, discovering why you can’t get ahead financially is crucial.

Here are 6 possible causes for why you can’t get ahead financially:

- You spend as much or more than what you make and putting money in savings is always an afterthought.

- You’re not financially prepared for emergencies. Even a small emergency can pile on more debt.

- You don’t have purchasing power. This means you can’t buy in bulk, so you pay a lot more for a smaller number of items.

- Fees are chipping away at your cash reserves.

- You have bad credit, so all of the debt you take out comes with high interest rates.

- You pay too much in taxes during the year and then treat yourself whenever you get a large tax return instead of using that money wisely.

Trust me. Your situation is not hopeless. So put on your big girl panties like I did and get to work.

To help you realize that you truly deserve this, here are some daily affirmations for you to say as you take control of your money and put it to work for you:

Getting Ahead Financially Once and For All

Getting ahead financially once and for all is possible. With a smart financial plan and completed steps in the process, anyone can make getting ahead financially their ultimate reality.

Fast forward several years, and I did it. I’m now debt-free minus, I was able to quit a toxic job I hated, and I’ve built financial security for myself and my family. Through all of my trials and tribulations, I learned the one trick that you need in order to get ahead financially when you have a low income.

Seriously, there’s only one. It’s certainly not quick. But it is simple. I promise you that.

You need to start an emergency fund, and you need to do it quickly. Having a large cash cushion saves you more money than you can ever imagine.

If you’re low-income, or even if you’re high-income with large bills and huge debt, it won’t happen overnight. You can’t just wave a magic wand and make extra money appear. I certainly wish you could.

But it is possible to get ahead financially even when it seems hopeless. You just need to put in the effort and refuse to give up like I did.

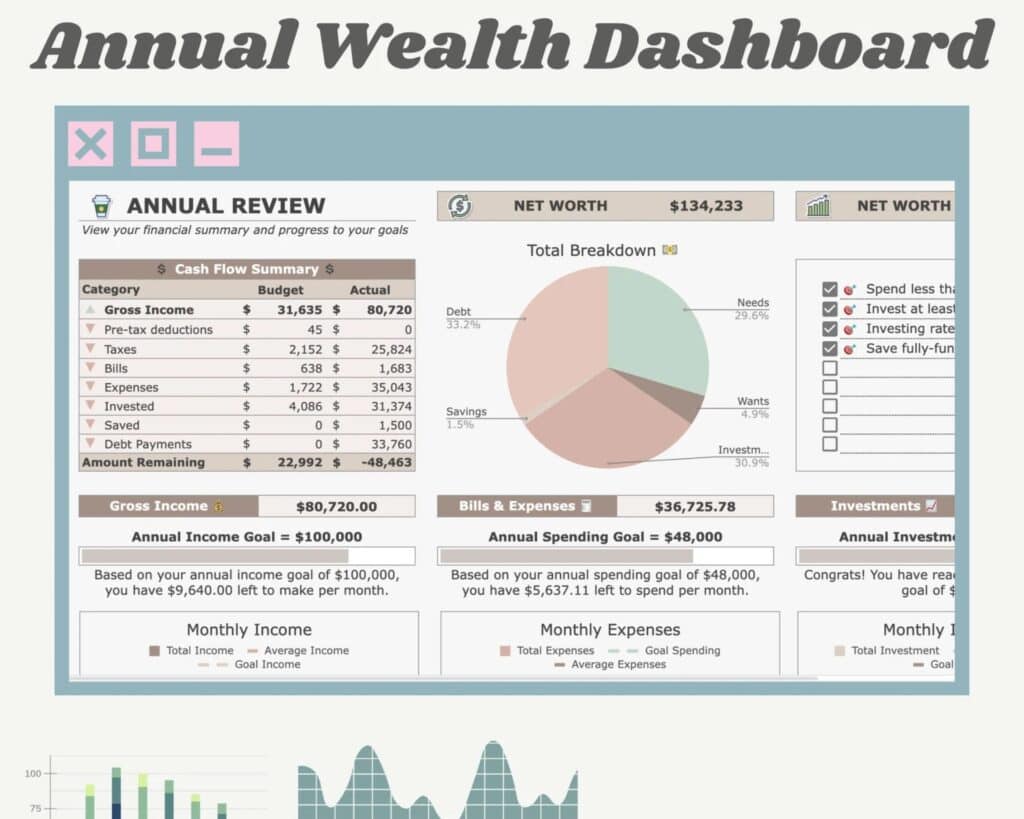

Brooke’s Top Pick For A Personal Finance Dashboard

Annual Wealth Dashboard by MyWealthDiary

- Completely customizable categories

- Track all income, expenses, savings, investments, debt, and net worth

- Monthly budget and annual review tabs

- Google Sheets

How to Get Ahead Financially

When you’re learning how to get ahead financially, you need to figure out where your money is going each month and create a plan to make your money work harder for you. Setting a budget, cutting unnecessary expenses, and building new sources of income will all help you get ahead financially over the long term.

Here are 11 steps to help you get started on getting ahead financially:

1. Figure Out Where Your Money is Going

Checking every account you use and tracking all of your expenses is the single most important step you can take to start saving money on a lower income. You need to know where your money is going now. Small purchases add up to a lot over time, and you’ll be surprised to find out just how much you’re spending each month on things you really can’t remember buying in the first place.

2. Set a Budget and Stick to It

Once you have a list of recent purchases, you can start setting a budget. You want to account for every dollar you make and tell it where to go. And don’t forget to automate savings by including it in your budget. You want to pay yourself first, not last. Sticking to your budget may not be fun at first, but it’s your ticket to getting ahead financially.

3. Eliminate Unnecessary Expenses

Cable, restaurants, lottery tickets, and expensive gifts are all luxuries—not necessities. If you want to get ahead financially, it’s important to cut out all of these unnecessary expenses from your budget as soon as possible. Even cutting back on them temporarily while you build an emergency fund is a huge step to getting out of debt and into financial security.

4. Cut Your Top Three Expenses

Housing, transportation, and food costs can all be budget killers. Looking at your top three expenses and doing whatever you can to bring them down is a significant step toward brightening your financial picture. You may need to move to a cheaper apartment or even sell your house for a more cost-effective one. Selling your car and replacing it with a car that you can afford to pay for in cash may also be a good idea. Lastly, you should plan and cook healthy meals at home instead of going out to eat. But the more seriously you take these steps to get ahead financially, the faster you’ll become debt-free and financially independent.

5. Negotiate Your Current Bills

Every bill you have is negotiable. I can’t stress enough how far being nice and asking for discounts will take you. All you need to do is call the companies you work with and ask if they have any discounts that are available to you at this time. When you’re polite, companies are happy to work with you in order to keep you as a customer. They often have programs or discounts that you’re not even aware of. Doing this one to two times per year can save you a lot of money in the long run, and it only takes a few minutes of your time.

6. Declutter

Going through your house and selling items that you no longer need is a great way to earn some extra money quickly. You can then set that money aside for an emergency fund or start to pay off debt. The more you declutter and start generating cash, the more you’ll realize how much stuff you have in your house that you really don’t need in the first place.

7. Borrow or Buy Used

Any time you buy an item new, you’re paying a huge surcharge for it. Just think of how quickly a brand-new car, jewelry, or even toys lose their value once you’ve purchased them. So whenever possible, borrow items you need or buy them used. This works especially well for items like tools you need for a quick household fix, a camper you need for one vacation, or a dolly you need to move one item. There’s no reason to buy any item new if you don’t have to use it multiple times over many years.

8. Make More Money

Anything you can do to make more money will speed up your goal to get ahead financially. Whether you get more training at work, ask for a raise, get a second job temporarily, or even start a side hustle dog walking or mowing lawns, the extra money you earn will make a big difference.

9. Use Your Extra Cash to Pay Off Debt

After saving a 3 to 6-month emergency fund, any extra cash you have should be funneled into paying off debt. It doesn’t matter if the extra cash comes from reducing your monthly expenses, selling your used items after decluttering, or getting a side hustle. Even a tiny amount of surplus cash will make a huge difference in paying off debt over time. Paying off debt will also increase your credit score, which, in turn, will help you save money on other things like auto insurance and interest rates.

10. Ask For Financial Tips

Everyone around you has advice that can help you save money, so don’t be afraid to ask people for their favorite money-saving hacks. They may have the perfect tips to help you find coupon codes, recipes for inexpensive freezer meals, or know how to save money on your utilities. The options for saving money are endless, and everyone you know has experiences with money that you can learn from. Just keep an open mind and try the suggestions they offer at least once to see if they are a good fit for you.

11. Have Patience and Keep at It

Working to get ahead financially will not be successful overnight, unfortunately. It will take some time. Have patience, set small financial goals to work toward, celebrate every financial win, and keep at it.

You can do this!

Get Ahead Financially

It’s always harder to get ahead financially when you make a lower income. You’ll see people with more money all around you, and you may feel like you should buy something now because it’s impossible to get ahead anyway. But it’s that mindset that’s trapping you right where you are.

Are there more financial obstacles to face on a lower income? Definitely! Will it take more time to save an emergency fund and get ahead financially? You betcha! But will you feel incredibly proud of yourself, provide financial security for your family, and experience the stress melting away from you when you accomplish it? Absolutely!

It’s okay to feel sorry for yourself when you’re facing financial difficulties and even to cry about it. I sure did. But I’m really stubborn, and I set my mind to overcoming it. I did what it took to get ahead financially, and now I’m debt-free and really enjoying that extra peace of mind, knowing that if my tire goes flat tomorrow or my water heater goes kaput, it won’t even matter.

Life presents us with challenges all the time, but when you save an emergency fund and pay off your debt, these challenges are merely annoyances and are no longer a crisis. Anyone can get ahead financially including you. And I’m right here cheering you on along the way.

FAQs

1. Why is it so hard to get ahead financially?

Still wondering why you can’t get ahead financially? It’s no secret that getting ahead financially is hard for many reasons. Having a lower income or higher expenses, not having purchasing power, and taking on debt are all contributing factors, to name a few.

2. Why can’t I get ahead financially?

The reason you can’t get ahead financially is because you’re spending more money than you are earning and saving. No matter how much money you make, you can only get ahead financially when you spend less than what you make and save money.

3. What is the best way to get ahead financially?

The best way to get ahead financially is to recognize that you are in control of your money, not the other way around. Set some short and long-term financial goals then tell each dollar you earn where to go in order to achieve those financial goals.

Sources

Love What You’re Seeing So Far?

- Enjoy community support

- Never miss a life-changing post again

- Get immediate access to the free resources library

- Be the first to know about giveaways

What hacks can you use to get ahead financially? Share your thoughts in the comments section below.

well i can relate seems i get close but then thats as far as it goes

You can do this! Put a plan in place, follow through, and pick up any extra cash you can to work toward your goals.

I’m a single Mom with an 18 year old in college now. I am working four jobs, I never have a day off, never any family time. Three days a week I work three of my four jobs n I would work more if I had another car. My son’s car broke down and he uses my car the other two days to go to school and so I can’t go to work my third job for the two nights. I have an ongoing list of things we need replaced or repaired. The car, washing machine, my son’s shower and bathroom floor, my carpeting and our oven and so on. I hate never having time do things with my son or visit with family living in other states. I’ve been offered full-time positions that will not pay enough for me to quit all my other jobs. I actually work 5 different jobs throughout the year. I seriously need help. Every time I think I am doing great and then something else fails me and I need to redirect money or charge something. I just want to make enough money to support us. Can’t afford to live…can’t live my best life or make it great for my son, my daughter and my grandkids that I can never even go visit.

I’m so sorry you are going through all this. Sometimes it can seem impossible to get ahead. My advice is to make a plan. Work through the 10 steps I’ve described in detail. Accept any help you can get because this isn’t the time to feel bad or ashamed about it. We all need help from time to time. I certainly did. Lastly, be patient. It won’t happen overnight, but you are smart and capable and you can make this happen. Wishing you all the best.

So, if I read right, start the emergency savings first, then pay off credit cards?

I would because if you have another emergency, you’d probably have to put it on the credit card anyway and then you’d be adding even more to the balance. Another option would be to put some money towards both at the same. Whatever makes you feel the most comfortable.

Some solid advice right there! I am currently working on building up a more substantial emergency fund. It’s hard work and it takes all I have not to dip into it but definitely worth it long term.

It is hard work. But you are right, it is really worth it in the end.

I appreciate that you’ve pointed out how hard it is to save anything when you’re living on a low income. Most people don’t understand that the “pull yourself up by your bootstraps” approach is just not possible for some. It’s hard to get a job when you can’t list an address on a job application (if homeless). There is also a huge number of people who are “unbanked” and end up paying much more in fees just to cash a check. You’ve listed other examples of how hard it can be to save when you don’t have much coming in. Finding a way to create an emergency fund, however long it takes, is key. That has become clear as the COVID-19 pandemic continues.

Congratulations on becoming debt-free, Brooke!

Yes! Covid is another great reason why we all need emergency funds. You just never know what will happen next so you always have to be prepared to lose your income or have an expensive emergency.

My wife is working one full time job, a part time job at night & a job working about 4-5 hours every weekend. I’m working a job that’s had a lot of down time this year with no overtime in over 2 years but I have sciatic nerve problems as well as knee problems so it makes it hard for me to do my stand up job let alone considering doing another job(we also have 5 kids too). We can’t keep up with our bills & my wife is worn out from all the work. I’m considering getting a loan or hardship loan from my 401(k). I have over $300,000 in it(I’m 57 & my wife is 43). Any help on this would be most appreciated!

I’m so sorry that the two of you are working so hard and still struggling financially. My advice is to take the time to look at each and every one of your bills and either eliminate them entirely or look for ways to lower them. While a hardship loan from your 401(k) can help you momentarily, how will you ever repay it if you are barely getting by now? You might have to move, sell a car, barter with friends and neighbors, or even take advantage of free resources in your area, but you can get ahead and even start saving with the right strategy in palce. I promise you that it won’t be easy, but you can absolutely do this. Sending you all the positive vibes you need!

Having an emergency fund is so important for when life gets thrown upside down and you need money to cover it all.

Very true. And it saves you money in the long run too.

Oh wow! So much truth in this post. I talk about the same things in my new book. I love this. More people should get their hands on such a read. Good job!

I absolutely need an emergency fund that I can’t dip into when I feel like it! I’m constantly living paycheck to paycheck and it’s not comfortable or sustainable at all. Some really great tips here hun x

Yes! It is so stressful living paycheck to paycheck. Having an emergency fund brings safety and more joy to your life for sure.

All great ideas. Hard to do at the same time.

It can definitely be hard to do at first. Just focus on one small task at a time and it will seem a lot less overwhelming. You’ve got this!

The emergency fund is a good idea and we always look to stay out of debt.

It makes life so much easier in the long run. Glad you are avoiding debt too.